Every January, millions of people on Medicare Part D wake up to find their prescriptions have changed - not because their doctor ordered it, but because their insurance plan did. In 2025, these changes are bigger than ever. The Inflation Reduction Act of 2022 didn’t just tweak the system; it rewrote the rules. And if you’re taking any chronic medication - especially for diabetes, arthritis, or heart disease - you need to know what’s coming.

What Exactly Is a Formulary Update?

A formulary is just a list of drugs your insurance will pay for. It’s not set in stone. Every year, your plan - whether it’s through UnitedHealthcare, CVS Caremark, or Express Scripts - can swap out medications, move them to higher cost tiers, or drop them entirely. These are called formulary updates. For 2025, over 70% of standalone Medicare Part D plans made major changes, mostly pushing patients toward cheaper generics and biosimilars.

Why? Because it saves money - for the insurer, not always for you. But there’s a twist: the new law caps your out-of-pocket drug spending at $2,000 a year. That means if you were hitting the old "donut hole," you’re now getting full coverage after you hit $5,030 in total drug costs. Sounds good, right? But here’s the catch: to hit that cap, your plan has to push you into cheaper alternatives first.

How Generic Switching Works - And Why It’s Getting Aggressive

Generic drugs are chemically identical to brand-name versions but cost 80-90% less. Biosimilars are similar to biologic drugs (like Humira or Enbrel) but aren’t exact copies. They’re still highly effective and much cheaper. In 2024, only about 28% of eligible biologics were replaced by biosimilars. By 2027, that number could jump to 45%.

Insurers are now actively moving patients off expensive brands. CVS Caremark, for example, removed nine specialty drugs in 2025 - including Herzuma and Ogivri - and replaced them with biosimilars like Kanjinti and Trazimera. UnitedHealthcare moved Humalog insulin to a higher tier, raising copays from $35 to $113 overnight. One Reddit user called it "a financial slap in the face."

But not all switches are bad. A user on HealthUnlocked reported switching from Humira to Amjevita (a biosimilar) saved her $450 a month with zero difference in how she felt. That’s the win. The problem? Too many switches happen without warning - or without a doctor’s input.

The Four Ways Your Insurance Can Force a Switch

It’s not random. There are four standard tactics insurers use:

- Drug exclusions - Your medication is simply removed from the list. No more coverage. Period.

- Tier reassignment - Your drug moves from Tier 1 (cheap) to Tier 3 (expensive). Your copay might triple.

- Prior authorization - You can’t get the drug unless your doctor jumps through hoops to prove you "really need it."

- Step therapy - You have to try and fail on a cheaper drug first before you can get the one you’re on.

For example, if you’re on Stelara for psoriasis, your plan might force you to try a biosimilar first - even if you’ve been stable for years. That’s step therapy. If your doctor doesn’t push back, you might end up with a flare-up - and a hospital bill.

Who’s Making These Decisions? (Spoiler: Not Your Doctor)

These changes aren’t made by clinicians. They’re made by pharmacy benefit managers (PBMs) - big middlemen like OptumRx, CVS Caremark, and Express Scripts. They control 84% of the Medicare Part D market. Their job? Cut costs. Clinical safety? That’s secondary.

Dr. Richard Mendelson from Milliman says insurers are shifting from "rebate-driven" coverage (where they profit from high-priced brands) to "cost-containment" - meaning they now profit when you use generics. That’s why 78% of standalone Part D plans are aggressively pushing generics in 2025, compared to just 42% in Medicare Advantage plans.

And it’s working. In 2024, 17 new biosimilars were approved. In 2025, expect more. But the FDA has also eased rules - you no longer need a drug to be labeled "interchangeable" for your plan to switch you. That means even more changes are coming.

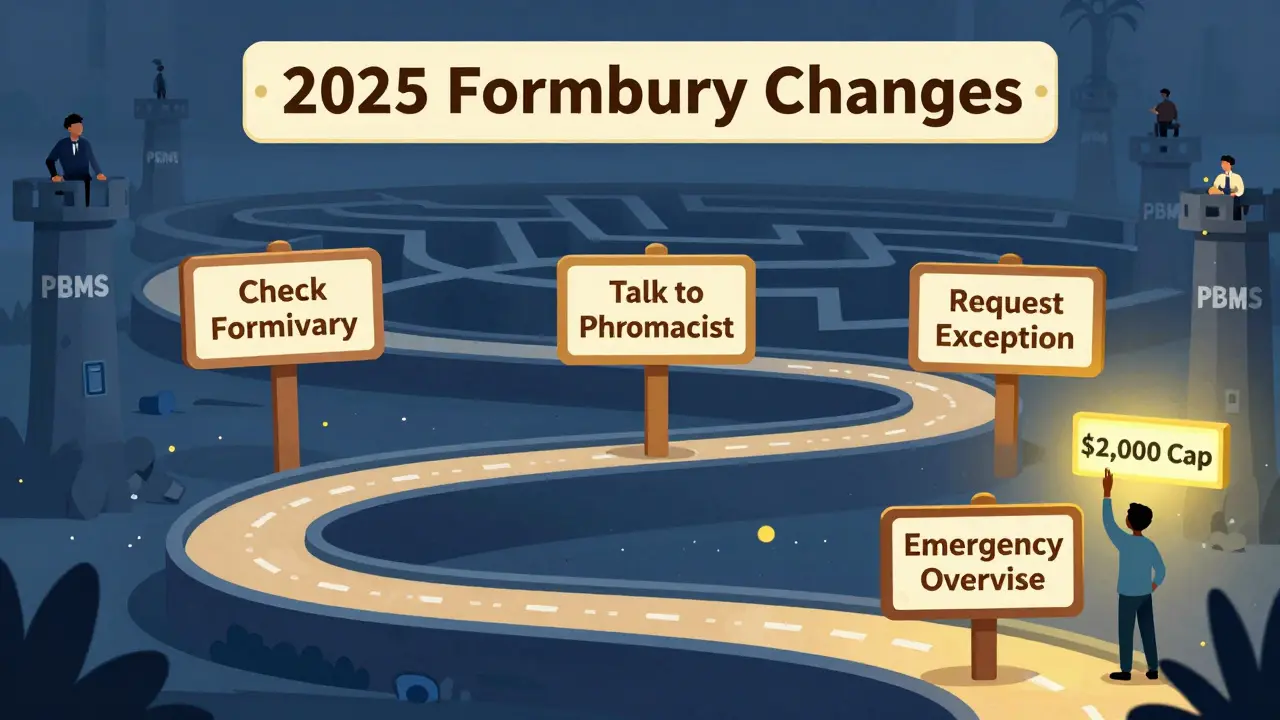

What You Can Do: A 5-Step Action Plan

You can’t stop formulary changes. But you can control how they affect you. Here’s how:

- Check your plan’s formulary between October and December. Every insurer sends a Summary of Coverage (SOC) by October 1. Don’t ignore it. Look up your exact drug name - including dosage and brand/generic.

- Ask your pharmacist. Pharmacists see formulary changes every day. They’ll know if your drug is being moved or dropped. Bring your list of meds to your next visit.

- Call your doctor. If your drug is being switched or restricted, ask if they’ll file a prior authorization or exception request. In 2024, 73% of exceptions were approved - but only if your doctor fought for it.

- Know your exception rights. If your drug is removed, you can request a temporary 30-day supply while your exception is reviewed. Some plans even give you 60 days to transition.

- Apply for an expedited exception if you’re at risk. If stopping your medication could cause a health emergency (like insulin withdrawal or steroid rebound), request an expedited review. It must be processed in 24 hours.

Don’t wait until January 1. That’s when the changes hit. Start now.

What’s Coming in 2026 - And Why It Matters

2025 is just the warm-up. In January 2026, the Medicare Drug Price Negotiation Program kicks in. For the first time ever, the government will negotiate prices on 10 high-cost drugs - including Stelara, Prolia, and Xolair. And your plan must cover them at the new lower price.

That means biosimilars for these drugs will flood the market in early 2026. If you’re on one of these drugs now, your plan will likely push you to the biosimilar version - even if you’ve never had a problem. And this time, there’s no way around it.

By 2029, the list will grow to 20 drugs. That’s over half of the top-selling biologics. The goal? Cut prices by at least 25%. The side effect? More mandatory switches.

When Switching Goes Wrong - And How to Spot It

Not every switch is safe. AARP found that 42% of Medicare beneficiaries are worried about changes to their diabetes meds. Why? Because insulin, metformin, and GLP-1 drugs are often moved to higher tiers - and if you can’t afford them, you skip doses.

Dr. Karen Ignagni warns that "over-aggressive generic substitution" can harm vulnerable patients. One case: a 72-year-old with rheumatoid arthritis switched from Humira to a biosimilar and developed severe joint pain within weeks. Her doctor had no idea the switch happened - until she showed up in the ER.

Red flags:

- Your copay jumps suddenly - especially if it’s over $100.

- You’re told you can’t refill your prescription without a new form.

- Your doctor says they didn’t approve the change.

- You feel worse after switching - fatigue, rashes, flare-ups.

If any of this happens, contact your plan immediately. File an exception. Ask for a transitional supply. Don’t go without your meds.

Final Reality Check

Generic switching isn’t evil. It’s necessary. Biologics cost $20,000 a year. Generics cost $2,000. That’s a 90% drop. That’s how we make healthcare sustainable.

But when the system prioritizes savings over safety - and when patients are treated like cost centers - people get hurt. The 2025 changes are a test. Will insurers use this power responsibly? Or will they keep pushing patients into cheaper options without regard for outcomes?

One thing’s certain: you can’t sit back. If you’re on a chronic medication, you’re now a participant in a complex financial system. Know your drugs. Know your plan. Know your rights. And don’t let a formulary change decide your health.

What if my insurance drops my medication completely?

If your drug is removed from the formulary, you can request a standard exception - your doctor submits a letter explaining why you need it. Approval rates are 47% for fully excluded drugs, so don’t give up. You’re also entitled to a 30-day transitional supply to give you time to appeal or switch safely.

Can I stay on my brand-name drug if it’s cheaper than the generic?

No - insurers don’t care if the brand is cheaper. Their goal is to steer you toward the lowest-cost option, even if it’s a biosimilar or another generic. If you want to stay on your current drug, you’ll need an exception based on medical necessity - not price.

How do I find out if my drug is affected?

Check your plan’s Summary of Coverage (SOC), sent every October. You can also log into your insurer’s website and search your drug in their formulary tool. If you’re unsure, call your pharmacy - they get daily updates on formulary changes.

Are biosimilars really as safe as the original drugs?

Yes. The FDA requires biosimilars to show no clinically meaningful differences in safety, purity, or potency compared to the original. Over 100 biosimilars have been approved in the U.S. since 2015, and real-world data shows similar effectiveness and safety profiles. But individual reactions vary - so monitor how you feel after switching.

Will the $2,000 out-of-pocket cap help me if I’m on expensive drugs?

Absolutely. Before 2025, people on high-cost drugs could pay over $7,000 a year just to reach the catastrophic phase. Now, once you hit $2,000, your plan covers 100% of the rest. If you’re on a biologic like Humira or Stelara, you could save $3,000 or more - as long as you don’t get switched to a drug you can’t afford.

What to Do Next

Start by pulling your medication list - all of them, including over-the-counter and supplements. Then, check your plan’s formulary before December 1. Talk to your pharmacist and doctor. If something looks off, file an exception. Don’t wait for a bill to come in. The system is designed to move fast. You need to move faster.

And remember: you’re not powerless. The law gives you rights. Use them.

Peter Sharplin

I’ve been on Humira since 2018. Switched to Amjevita last January-zero flare-ups, zero side effects. Saved $500/month. My rheumatologist didn’t even know the switch happened until I told him. Insurers don’t care about your history, only the bottom line. But if you’re stable? Give it a shot. Not all switches are traps.

Just make sure you log how you feel the first month. Track fatigue, joint pain, skin reactions. If something’s off, don’t wait-file an exception. You’ve got rights.

And yes, the $2k cap is a game-changer. I hit it by June. Now my insulin’s free. That’s the win.

shivam utkresth

Bro, in India we call this ‘pharma colonialism’-big pharma makes $20k drugs, then outsources the cheap generics to us, but when it’s our turn to get the biosimilar? Nah, we get the overpriced brand. Meanwhile, your Medicare gets the discount and we pay full price for the same damn drug.

It’s not about savings-it’s about who gets to benefit. The system’s rigged. But hey, at least you folks have exceptions. We just pray our doctor remembers to write ‘medical necessity’ on the scrip.

John Wippler

Let’s be real: this isn’t about drugs. It’s about who gets to be human in a system that treats bodies like balance sheets.

Insurance companies didn’t wake up one day and say, ‘Hey, let’s be evil.’ They were told to cut costs. And so they did-by shifting risk onto patients who can’t afford to fight back.

But here’s the truth no one wants to say: we let them. We don’t read the SOC. We don’t call our pharmacists. We wait until January 2nd, panic-buy a 30-day supply, and then wonder why we’re in the ER.

Knowledge isn’t power here. Action is. And action starts with one phone call.

Don’t wait for the system to protect you. Protect yourself. Now.

Aurelie L.

My mom got switched from Stelara to a biosimilar and ended up in the hospital with a full-body rash. They didn’t even tell her it was happening. Now she’s on 3 new meds just to fix the side effects. So yeah. This isn’t ‘cost-saving.’ It’s negligence wrapped in a spreadsheet.

Joanna Domżalska

Wow. So the solution to expensive drugs is to force people onto cheaper ones? Genius. Next they’ll make us eat rice instead of bread to save on carbs.

Let me guess-your ‘5-step plan’ is just a way to make you feel like you’re in control while the system laughs all the way to the bank.

Also, biosimilars? Yeah, sure. Until you’re the one with the autoimmune flare-up because some algorithm decided you were ‘low risk.’

Ashley Porter

Formulary changes are just PBM arbitrage. They buy drugs at a discount, then resell them to plans with rebates. The more expensive the brand, the bigger the rebate. So they push generics not because they’re better-but because they’re profitable.

It’s not healthcare. It’s financial engineering with a stethoscope.

Kipper Pickens

Insurers are now using AI-driven formulary engines. They don’t even need humans to make these calls anymore. Algorithms analyze your age, diagnosis, refill history, and zip code to predict who’ll tolerate a switch and who’ll sue.

And guess what? If you’re over 65, live in a rural area, and take insulin? You’re flagged as ‘high-risk for non-adherence.’ So they push you harder.

It’s not just about cost-it’s about predictive risk modeling. And we’re the data points.

Faisal Mohamed

Man, I’m just glad I’m not on insulin. 😅 But seriously-this is the future. Biosimilars are the new normal. If you’re still clinging to brand-name Humira like it’s a family heirloom… you’re gonna get left behind.

Just check your formulary. Talk to your doc. Don’t be a hero. The system’s broken, but you can still play it smart. 💪

rasna saha

I’m a nurse in Delhi, and I’ve seen patients here skip doses because they can’t afford their meds. Your $2k cap sounds like heaven. I wish we had that.

But your system? It’s still better than ours. At least you have a fight. We just pray someone remembers to restock the shelves.